Progressive is the third biggest car insurance provider in the nation according to ValuePenquin, but if you are in an accident caused by one of their drivers that top-ranking may hurt you instead of making things easier. Large insurance companies have gotten very good at confusing injured victims and fooling them into accepting lowball offers for their hardship.

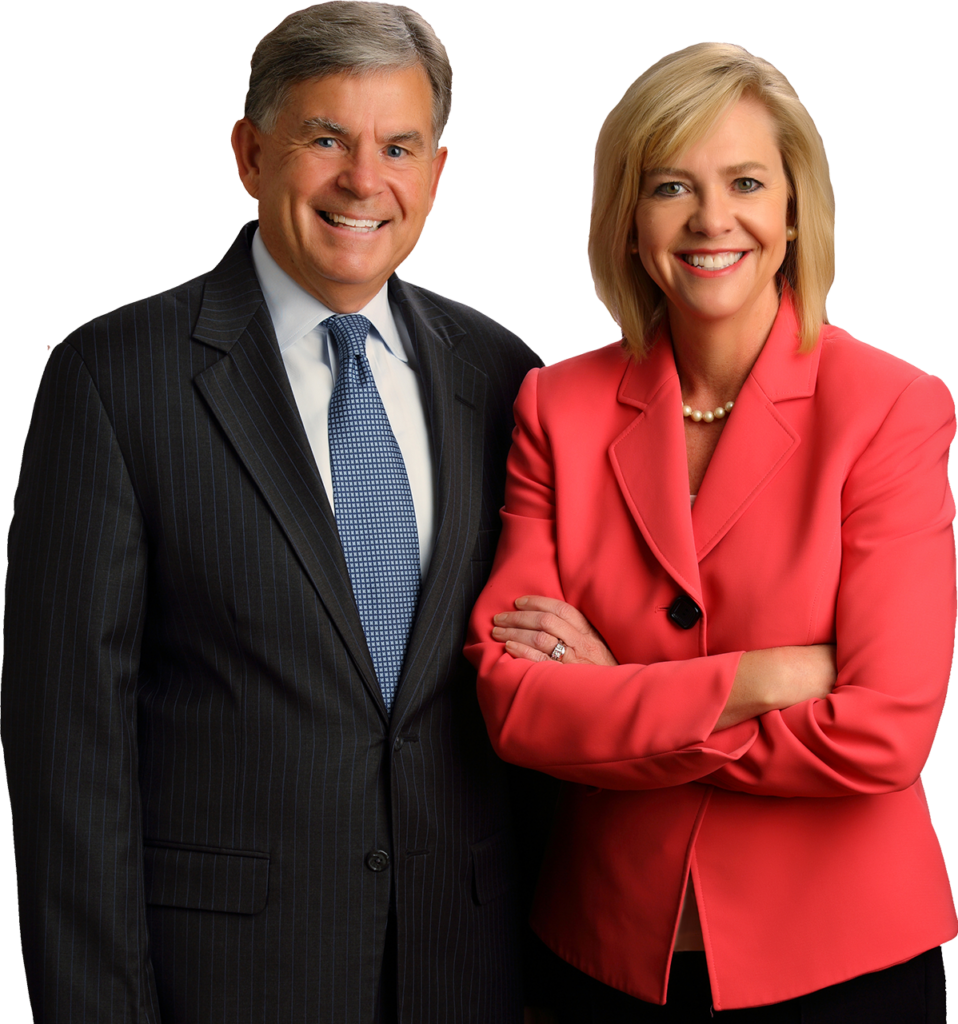

If you find yourself facing off against Progressive agents after an accident, don’t enter that fight alone. An attorney with Kaufman & Stigger, PLLC, of Louisville can provide a safety net to make sure you don’t get sent for a loop by insurance agents. You weren’t to blame for your wreck and you shouldn’t be left to face the resulting bills. Contact us today for a free evaluation of your case.

Progressive Insurance Pitfalls for Louisville Accident Victims

Progressive has now claimed 13% of the insurance market share and is only behind State Farm and Geico in policyholders. They write about 32 billion dollars in premiums a year.

The problem is they are big enough to make many of the insurance industry’s bad faith practices their standard procedure. They will toss victims into a big pool of phone representatives who are only allowed to offer so much in compensation for their injuries. They work off of a script and have the help of computer programs to tell them what your injury is worth. Of course, that estimate is always going to allow Progressive to save money on your claim.

Progressive has to pay for its ad campaigns that feature well-known spokespeople like Flo and Jaime. That’s why they seek to devalue your claim from the start. They especially want you to accept some blame for your accident. They also try to point out your past injury records to cast doubt on whether you were truly injured by their driver, all to leave you high and dry to pay for your own medical care.

Do’s and Don’ts When Dealing with Progressive After an Accident

You may feel helpless when dealing with another driver’s insurance provider. It can be a maze of paperwork and fine print unless you have an attorney looking out for your interests.

But there are some things you can accomplish to protect yourself, especially if you haven’t been able to talk to an attorney yet.

If you are, unfortunately, involved in a collision caused by a Progressive driver try to follow these tips to make sure you’re covered if Progressive starts looking for ways to blame you:

DO’S

- Call the police: Even if the damage is minor or you think you’re not hurt that badly, get a police report filed. It can be the most important piece of evidence to keep Progressive from trying to change the facts later.

- Gather evidence: Some evidence can disappear forever minutes after an accident. So if you’re physically able, grab your phone and start taking photos and video. Take images of car damage, license plates, street signs, and lane markings. Tell the story of the accident in photos. Find out where witnesses can be reached later. Exchange driver’s license and car insurance information with the other driver.

- Alert your own insurance: Tell your own agent what happened. Give them a brief, basic description. If Progressive tries to shift blame to you, your insurance agents may get involved, because they don’t want to be responsible for compensation any more than Progressive does.

DON’TS

- Making statements: Don’t offer the other driver any information on your injuries or how the accident occurred. Don’t offer any statements to Progressive representatives who will call afterward. One standard trick is to try to turn your statements around on you to hurt your case. Let your attorney handle communications with Progressive agents and lawyers.

- Posting to Twitter: It may be hard to resist venting on Facebook or Instagram but don’t do it. Progressive can find social media posts and turn them around to make you look bad. They can use this evidence to reduce the compensation you receive or throw your claim out altogether.

- Accepting a settlement: Don’t sign any documents or accept any quickly offered settlement. Your injury is worth more than you think, but you won’t know that until you talk to an attorney. Progressive can make you a quick offer in the hopes that you won’t have enough knowledge to tell that it’s a lowball offer. They can also stall their accident response to leave you more and more desperate as hospital bills and lost wages at work multiply. You may be desperate enough to accept any offer at that point. A lawyer working on your case can shine a light on these tactics.

If you’d like more information on dealing with other insurance companies in Kentucky click here.

Contact a Louisville Car Accident Attorney

If you are hit and seriously injured by a careless driver covered by Progressive in Louisville or anywhere in Kentucky, contact Kaufman & Stigger, PLLC, Injury Lawyers. Insurance companies aren’t required to tell injury victims about all the rights they have. Make sure you have someone on your side who will.

Talk to a Louisville Car Accident Lawyer you can trust to protect you and your family and fight for your fair compensation. The attorneys at Kaufman & Stigger, PLLC, have that knowledge and a combined 100 years’ experience in helping clients get the compensation they’ll need to make a full recovery.