Kentucky insurance premiums probably make up a big part of your monthly payments. You might be curious as to where that money goes? You hope to be covered in case of a bad accident, but there are other benefits of having an insurance policy you must stay informed of.

Insurance companies operating in Kentucky may not tell you about every perk you have as a policyholder. In some cases that lack of information and care is a violation of the contract you’ve entered into with your insurance agent. It can constitute “bad faith” practices and leave you eligible for legal compensation.

Your Kentucky Insurance Provider’s Responsibility to You

Insurance providers are required to act in your best interests in any accident claim scenario. Unfortunately, they too often look after the interests and profits of their companies. They should act in “good faith” which means they take positive action to preserve your wellbeing physically, emotionally, and financially.

Insurance companies may indicate they’ll look out for you in their clever TV commercials, but actually practicing this in real life is another matter.

Your insurance company shouldn’t only be concerned about its own bottom line. They must act to protect their policyholders at what may be a difficult and vulnerable time. In fact, sometimes your own insurance representative will allow you to come to harm by acting in bad faith.

When they don’t rush to your defense, insurance companies can face scrutiny and in some cases be liable for bad faith practices. You could file a lawsuit to recover some of the funds your provider should have been providing anyway.

Policyholder Insurance Protections In Kentucky

These are just a few of the services and protections you may not realize your insurance company should be providing:

- Defend — Defending policyholders when they are falsely accused of causing an accident.

- Investigate — Conducting a reasonably thorough investigation into an accident, especially when fault is in question.

- Indemnify – Paying compensation to victims when you are found at fault in a personal injury accident. When an insurance company refuses to pay, that money will come out of your pocket.

- Keep You Informed – Updating you on where a claim filed against you stands. Alerting you to any rulings made on your case or insurance settlements reached.

- Explain Your Benefits – This often involves the fine print of your policy. Insurance representatives are acting in bad faith when they don’t tell you about something in your contract that could help you.

- Explain Denial of Coverage – If your insurance provider decides not to defend you in an accident case, or refuses to give victims compensation, they must adequately explain the reasons.

- Taking Prompt Action – Insurance companies know that policyholders and victims can get more and more desperate the longer they wait. They think this waiting game makes it more likely victims and policyholders will accept less support than they are owed.

Bad Faith Claims Against Kentucky Insurance Companies

After a personal injury accident like a car crash or if someone gets hurt on your property, you may suspect your insurance company isn’t fulfilling their duties. They may not be providing you the services you pay for every month. They could be denying coverage to victims for a “covered risk,” only to leave you financially responsible.

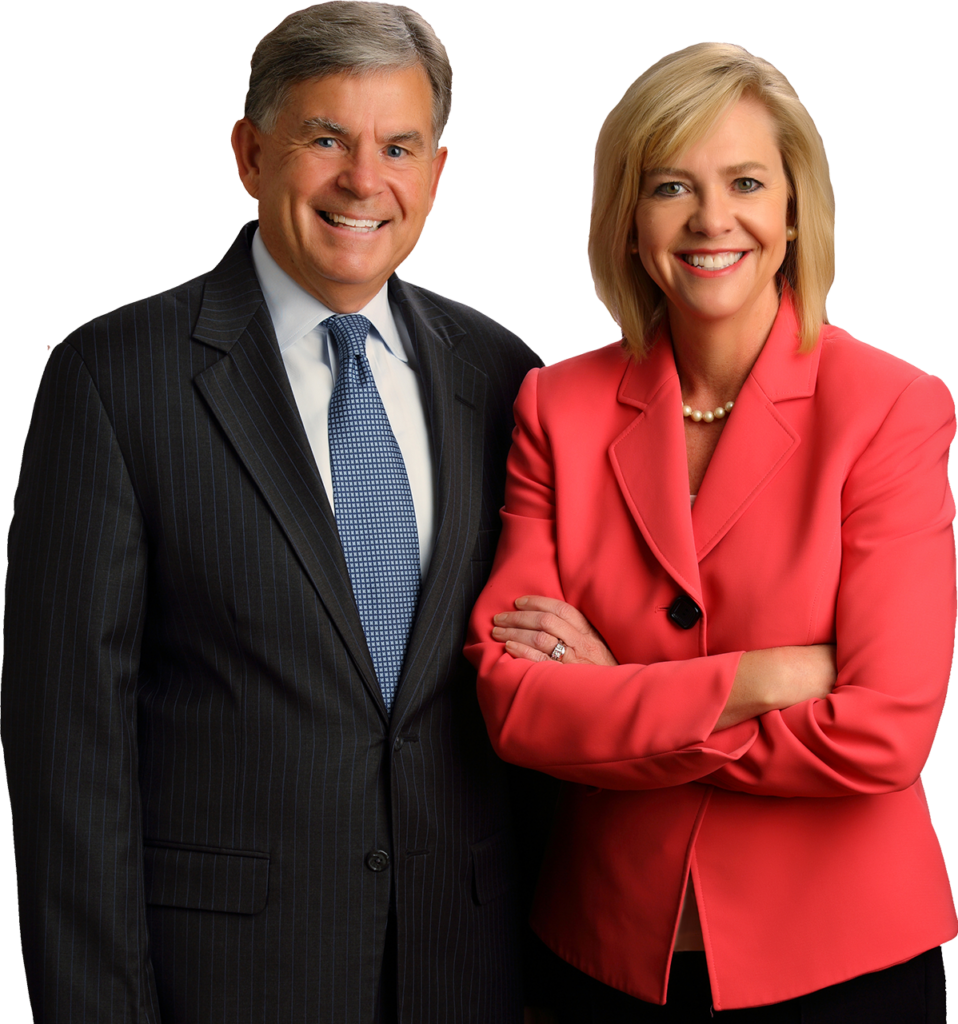

A Kentucky personal injury lawyer can help you file a “bad faith” lawsuit against an insurer and get results on your case. Kaufman & Stigger Injury Lawyers, PLLC, have an exhaustive amount of experience forcing unhelpful insurance companies to do the right thing. We offer a free consultation to anyone who feels they have suffered damages from the inaction of an insurance provider.

Spotlighting an issue of “bad faith” behavior doesn’t have to lead to a court battle. Often the threat of a lawsuit delivered by a personal injury lawyer is the motivation an insurer needs to treat their customers fairly.

What Kind of Compensation Can I Expect from a Bad Faith Claim?

When insurance companies don’t comply with their duties, they may owe you a considerable amount of compensation. This is beyond the services they already should have already been backing you with.

In a settlement with the insurance provider or in a judgment in court, they may be forced to provide money to cover the attorney and court fees you’ve paid to bring your case forward. The money you were forced to pay out to victims while your insurance company was dragging its feet is also reimbursed.

A court can also assign punitive damages that would be paid to you. These damages are meant to increase the impact of penalties the insurer faces for bad faith behavior. These additional fees are levied to act as a further deterrent for your insurance company and others from engaging in bad faith practices again.

Other Unethical Insurance Practices Against Kentucky Victims

You can certainly experience unfair treatment from another party’s insurance company too. This often occurs while you are trying to get injury support over an incident you weren’t to blame for.

Insurance companies can delay providing support or refuse to pay you what’s fair after you’ve been hurt. They may also attempt to falsely accuse you of causing the accident that left you injured.

When you experience this sort of treatment, it’s a great time to talk to Kentucky personal injury lawyer about your options. You likely face a pile of hospital bills and have been out of work for days or weeks. Your financial situation may be reaching crisis mode. This is when insurance companies like to take advantage of injury victims. Allow a skilled Kaufman & Stigger, PLLC, attorney to turn the tables on an insurance adjuster and ensure you receive the maximum compensation available.

Contact a Kentucky Personal Injury Lawyer After Problems with an Insurance Provider

After a Kentucky accident, insurance companies are legally obligated to jump in and help everyone involved receive the help they need. If your insurance provider or another party’s provider seems to be negligent in this duty, contact the experienced attorneys at Kaufman & Stigger, PLLC. Take advantage of a free case evaluation to discuss your options. You have strong legal recourse when an insurance representative isn’t treating you or your family fairly.